Navigating Rural Opportunities: A Guide to USDA Loans in Texas

Related Articles: Navigating Rural Opportunities: A Guide to USDA Loans in Texas

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating Rural Opportunities: A Guide to USDA Loans in Texas. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Rural Opportunities: A Guide to USDA Loans in Texas

The United States Department of Agriculture (USDA) offers a variety of loan programs designed to support rural development and economic growth. Among these, USDA Rural Development loans play a significant role in assisting individuals, families, and businesses in accessing affordable financing for housing, business ventures, and community infrastructure.

Texas, with its vast rural landscapes and diverse agricultural economy, presents a particularly fertile ground for USDA loan programs. This article provides a comprehensive overview of USDA loan programs in Texas, highlighting their key features, eligibility criteria, and potential benefits.

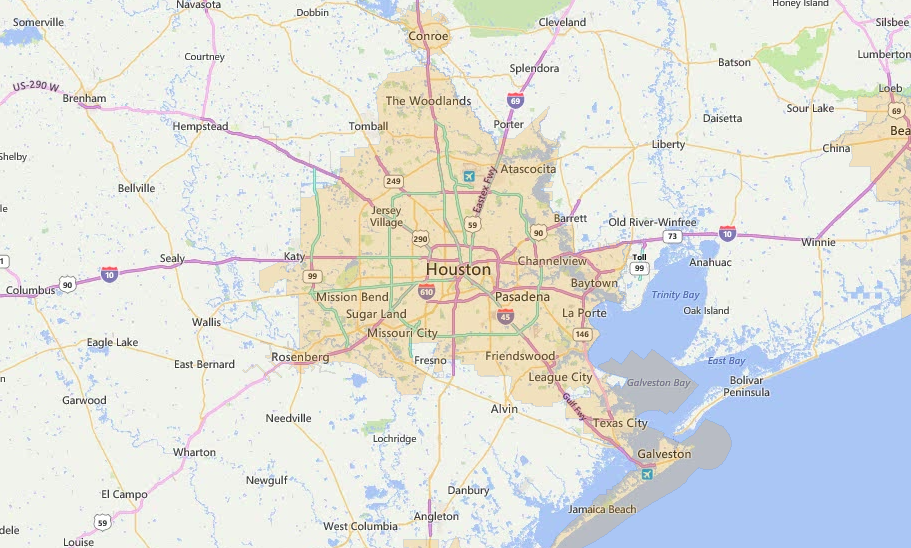

Understanding the USDA Loan Map in Texas

The USDA Rural Development loan program utilizes a "rural area" designation to determine loan eligibility. The USDA Rural Development map, available online, outlines the specific areas within Texas that qualify for these loan programs.

Identifying Eligible Areas:

- Rural areas: These areas are defined as those that are not classified as urban or suburban. They typically have a lower population density and are characterized by a predominantly agricultural or rural economy.

- Census tracts: The USDA uses Census tracts to define rural areas. These tracts are small geographic areas with a population of 1,500 to 8,000 individuals.

- Population density: Areas with a population density of less than 1,000 people per square mile are generally considered rural.

Benefits of USDA Loans in Texas:

- Lower interest rates: USDA loans often offer lower interest rates compared to conventional mortgage loans, making homeownership more accessible.

- Flexible financing options: The USDA offers various loan programs catering to different needs, including homeownership, business development, and community infrastructure projects.

- Affordable housing: USDA loans aim to provide affordable housing options in rural areas, promoting equitable access to homeownership.

- Economic development: By supporting business ventures and community projects, USDA loans contribute to the economic growth and prosperity of rural communities in Texas.

- Community revitalization: USDA loans can be instrumental in revitalizing rural areas by fostering new businesses, improving infrastructure, and attracting new residents.

Types of USDA Loans in Texas:

1. Single-Family Housing Loans:

- Direct Loan Program: The USDA provides direct loans to eligible borrowers with limited income who cannot obtain financing through conventional means. This program offers a range of loan products, including fixed-rate mortgages, adjustable-rate mortgages, and home improvement loans.

- Guaranteed Loan Program: The USDA guarantees loans made by private lenders to eligible borrowers. This program allows borrowers to access financing at competitive rates with lower down payment requirements.

2. Multi-Family Housing Loans:

- Rural Rental Housing Loans: These loans assist in developing and rehabilitating rental housing for low- and moderate-income families in rural areas.

- Rural Housing Preservation Loans: These loans help preserve existing affordable rental housing by providing financing for renovations, repairs, and upgrades.

3. Business and Community Facilities Loans:

- Rural Business Development Grants: These grants provide funding for small businesses in rural areas, supporting job creation and economic growth.

- Community Facilities Loans: These loans assist in financing essential community infrastructure projects, including water and wastewater systems, broadband internet access, and healthcare facilities.

Eligibility Criteria for USDA Loans in Texas:

1. Location: The property must be located in a designated rural area within Texas, as defined by the USDA Rural Development map.

- Income: Borrowers must meet income eligibility requirements based on the USDA’s median income guidelines for the specific county or area where the property is located.

- Creditworthiness: Borrowers must have a satisfactory credit history and meet minimum credit score requirements.

- Property type: The property must be a single-family home, a multi-family housing unit, or a business or community facility that meets USDA eligibility criteria.

How to Apply for a USDA Loan in Texas:

- Contact a USDA Rural Development office: Begin by contacting your local USDA Rural Development office to discuss your loan options and eligibility.

- Gather required documentation: Prepare necessary documents, such as proof of income, credit history, and property information.

- Submit a loan application: Complete and submit a loan application through the USDA’s online portal or via mail.

- Loan processing: The USDA will review your application and conduct a property appraisal.

- Loan approval and closing: Upon loan approval, you will work with the USDA and your chosen lender to complete the loan closing process.

FAQs About USDA Loans in Texas:

Q: What are the down payment requirements for USDA loans?

A: USDA loans generally require a 0% down payment for eligible borrowers.

Q: Are there any closing costs associated with USDA loans?

A: Yes, there are closing costs associated with USDA loans, similar to conventional mortgages. However, these costs may be lower than those associated with conventional loans.

Q: Can I use a USDA loan to purchase a manufactured home?

A: Yes, USDA loans can be used to purchase manufactured homes, but they must meet specific requirements regarding size, foundation, and location.

Q: What is the maximum loan amount for a USDA loan?

A: The maximum loan amount for a USDA loan varies depending on the location and property type. However, there are maximum limits set by the USDA.

Q: What are the interest rates for USDA loans?

A: USDA loan interest rates are generally lower than conventional mortgage rates. The specific interest rate will depend on factors such as the loan term, creditworthiness, and market conditions.

Tips for Applying for a USDA Loan in Texas:

- Research your eligibility: Before applying, thoroughly research the USDA loan program requirements and ensure you meet the eligibility criteria.

- Contact a qualified lender: Consult with a lender experienced in USDA loans to discuss your loan options and obtain pre-approval.

- Prepare your documentation: Gather all necessary documentation, such as income verification, credit history, and property information, to ensure a smooth application process.

- Consider the property’s location: Ensure the property you are interested in is located within a designated rural area in Texas.

- Seek professional advice: Consult with a financial advisor or real estate agent to understand the complexities of USDA loans and make informed decisions.

Conclusion:

USDA loans play a vital role in supporting rural development and economic growth in Texas. By providing affordable financing options for housing, business ventures, and community infrastructure projects, these programs empower individuals, families, and communities to thrive in rural areas. By understanding the eligibility criteria, benefits, and application process, individuals and businesses can leverage these programs to achieve their goals and contribute to the prosperity of rural Texas.

Closure

Thus, we hope this article has provided valuable insights into Navigating Rural Opportunities: A Guide to USDA Loans in Texas. We thank you for taking the time to read this article. See you in our next article!