Navigating the Waters: Understanding Flood Insurance Maps and Their Significance

Related Articles: Navigating the Waters: Understanding Flood Insurance Maps and Their Significance

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Waters: Understanding Flood Insurance Maps and Their Significance. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Waters: Understanding Flood Insurance Maps and Their Significance

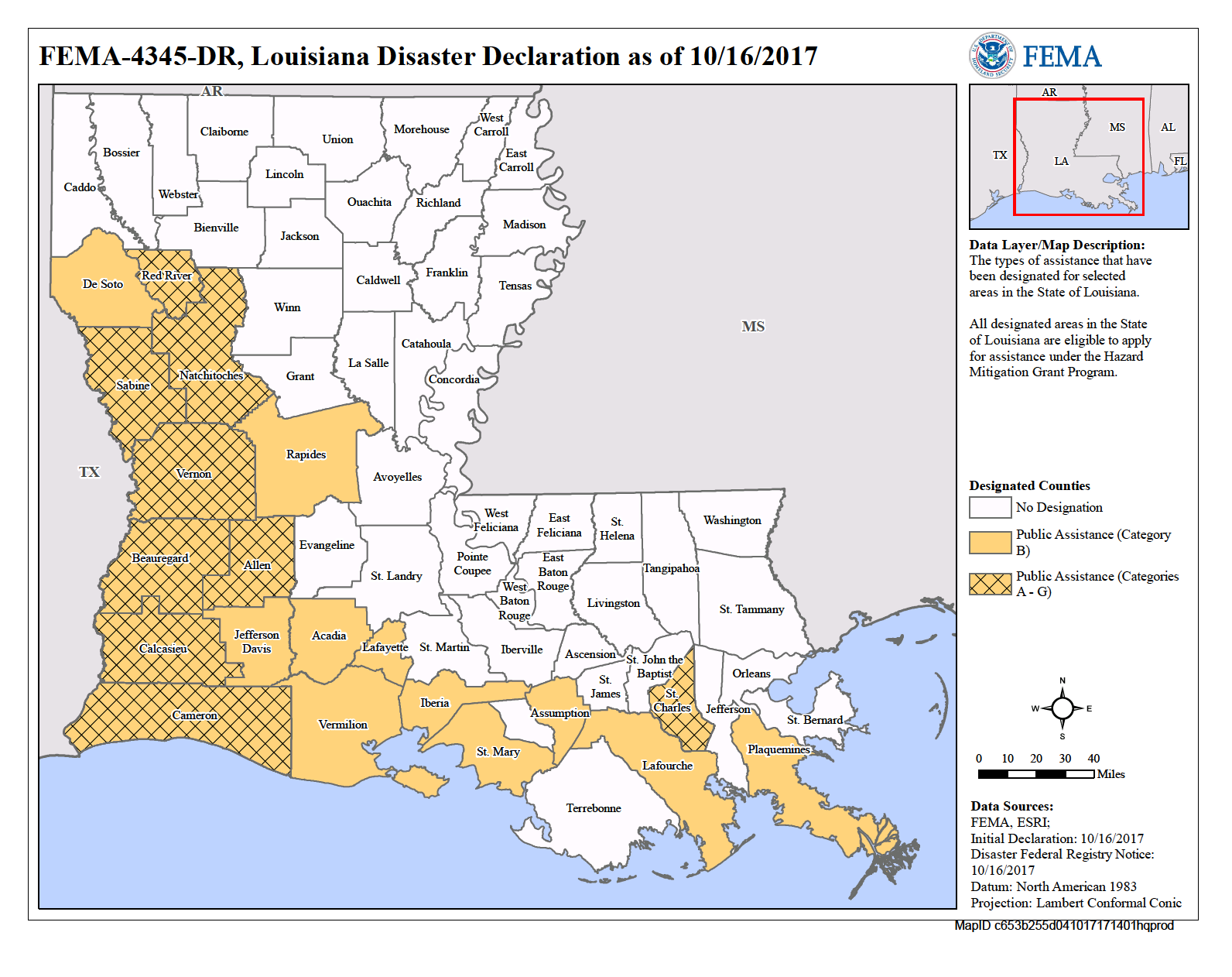

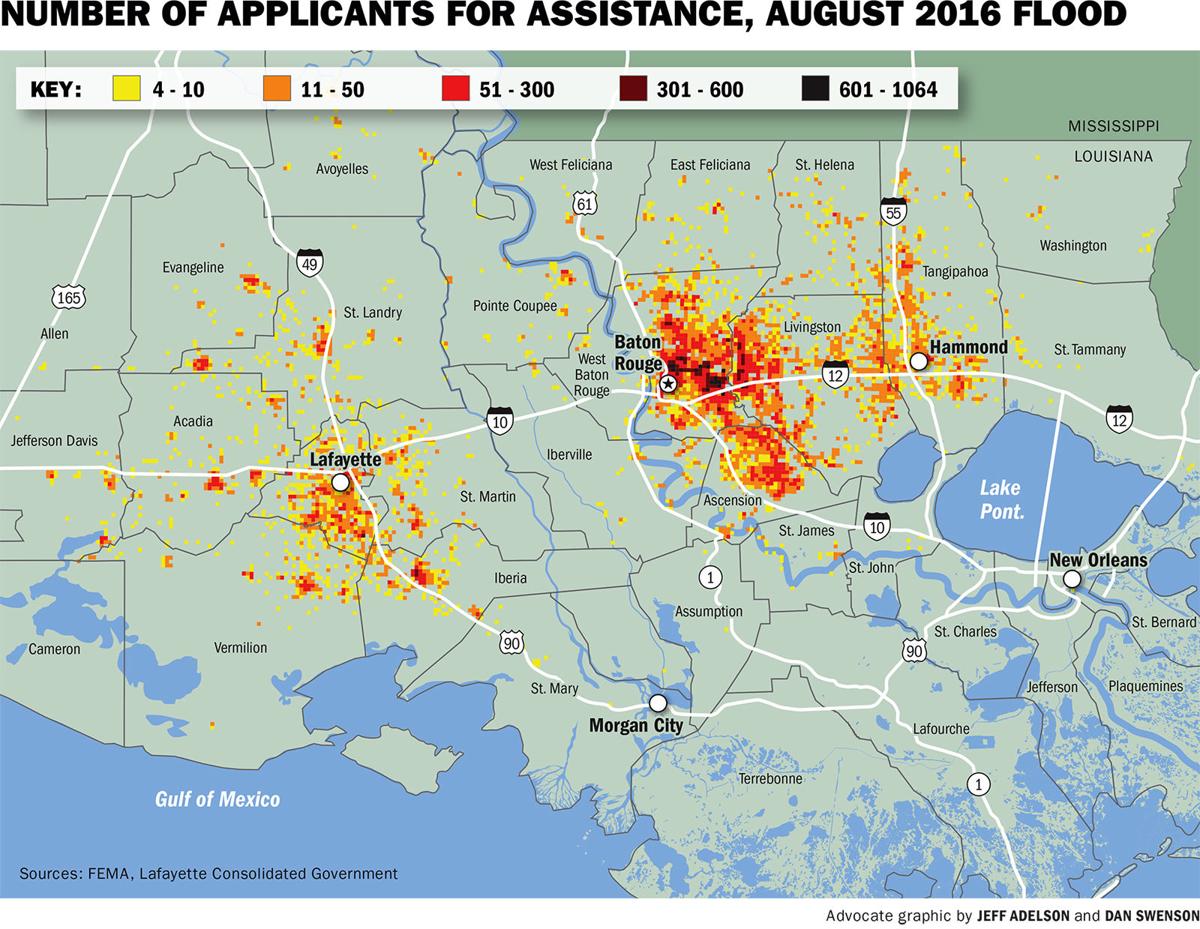

Flood insurance maps, often referred to as FIRM (Flood Insurance Rate Maps), are essential tools for understanding flood risk and making informed decisions regarding property protection. These maps, developed by the Federal Emergency Management Agency (FEMA), provide a visual representation of flood zones, outlining areas susceptible to flooding based on historical data and scientific analysis. They serve as the foundation for the National Flood Insurance Program (NFIP), a federal program offering flood insurance to property owners in participating communities.

Delving Deeper into Flood Insurance Maps

Flood insurance maps are not static documents. They are dynamic and constantly evolving, reflecting the changing landscape of flood risks due to factors like climate change, urbanization, and infrastructure development. FEMA regularly updates these maps to incorporate new data and refine flood risk assessments. This dynamic nature underscores the importance of staying informed about map revisions and their implications.

Understanding the Different Flood Zones

Flood insurance maps categorize areas into different flood zones, each carrying a specific level of risk:

- Special Flood Hazard Areas (SFHAs): These zones represent areas with a 1% chance of experiencing a flood during any given year, often referred to as the "100-year floodplain." Properties located in SFHAs are generally required to purchase flood insurance if they are financed with a federally backed mortgage.

- Areas of Minimal Flood Hazard: These areas have a lower risk of flooding compared to SFHAs, but they are not entirely immune.

- Undetermined Areas: These zones are yet to be evaluated for flood risk.

The Importance of Flood Insurance Maps

Flood insurance maps play a crucial role in several aspects of flood risk management:

- Determining Flood Insurance Eligibility and Rates: The maps directly influence whether a property is eligible for flood insurance and the premium rates charged. Properties in SFHAs typically have higher premiums due to their increased flood risk.

- Guiding Development and Planning: By identifying flood-prone areas, these maps guide responsible development practices, minimizing construction in high-risk zones and promoting flood-resistant building techniques.

- Informing Public Policy: The maps provide valuable data to policymakers, enabling them to develop effective flood mitigation strategies, infrastructure improvements, and emergency preparedness plans.

- Raising Awareness and Education: Flood insurance maps serve as a critical tool for educating individuals and communities about flood risks, empowering them to make informed decisions regarding property protection and preparedness.

Navigating the Map: Key Components and Terminology

Flood insurance maps are complex documents containing a wealth of information. Understanding the key components and terminology is essential for effective utilization:

- Base Flood Elevation (BFE): This elevation represents the height of the flood water expected during a 100-year flood event.

- Flood Zones: As previously explained, these zones categorize areas based on their flood risk.

- Floodway: This area within a floodplain is designated for the conveyance of floodwaters. Development within a floodway is typically restricted to minimize flood impacts.

- Floodplain: This broader area encompassing the floodway is susceptible to inundation during a flood event.

- Regulatory Floodway: This specific area within the floodway is subject to stricter regulations, aimed at preserving the capacity of the floodway to carry floodwaters.

FAQs Regarding Flood Insurance Maps

Q: How can I find my flood zone?

A: Flood insurance maps are accessible online through FEMA’s website (www.fema.gov) or by contacting your local floodplain administrator.

Q: What if my property is not located in a flood zone?

A: Even if your property is not currently located within a flood zone, it does not guarantee complete immunity from flooding. Climate change and changing flood patterns can lead to unexpected flooding in previously unaffected areas. It is always wise to consider flood insurance, regardless of your flood zone designation.

Q: Can I appeal a flood zone designation?

A: Yes, you can appeal a flood zone designation if you believe it is inaccurate or unfair. FEMA provides a process for appealing decisions, involving submitting evidence and documentation to support your case.

Q: What happens if a flood insurance map is revised?

A: If a flood insurance map is revised, FEMA will notify property owners within the affected areas. These revisions can lead to changes in flood zone designations, insurance premiums, and building regulations. It is crucial to stay informed about map revisions and their implications.

Tips for Utilizing Flood Insurance Maps

- Consult a qualified professional: If you have questions or concerns about flood insurance maps, seek guidance from a qualified professional, such as a floodplain administrator, engineer, or insurance agent.

- Review your flood insurance policy: Ensure your policy provides adequate coverage for your property’s flood risk, considering the specific flood zone designation and potential flood hazards.

- Implement flood mitigation measures: Consider implementing flood mitigation measures, such as elevating your property, installing flood barriers, or landscaping to reduce flood impacts.

- Stay informed about map revisions: Regularly check for updates to flood insurance maps and be prepared for potential changes in your flood zone designation and insurance requirements.

Conclusion

Flood insurance maps are invaluable tools for understanding and managing flood risk. They provide a comprehensive overview of flood-prone areas, guiding development, informing policy decisions, and empowering individuals to make informed choices regarding property protection. By understanding the information contained within these maps and utilizing them effectively, communities can better mitigate flood risks, protect their properties, and ensure a safer future.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Waters: Understanding Flood Insurance Maps and Their Significance. We hope you find this article informative and beneficial. See you in our next article!